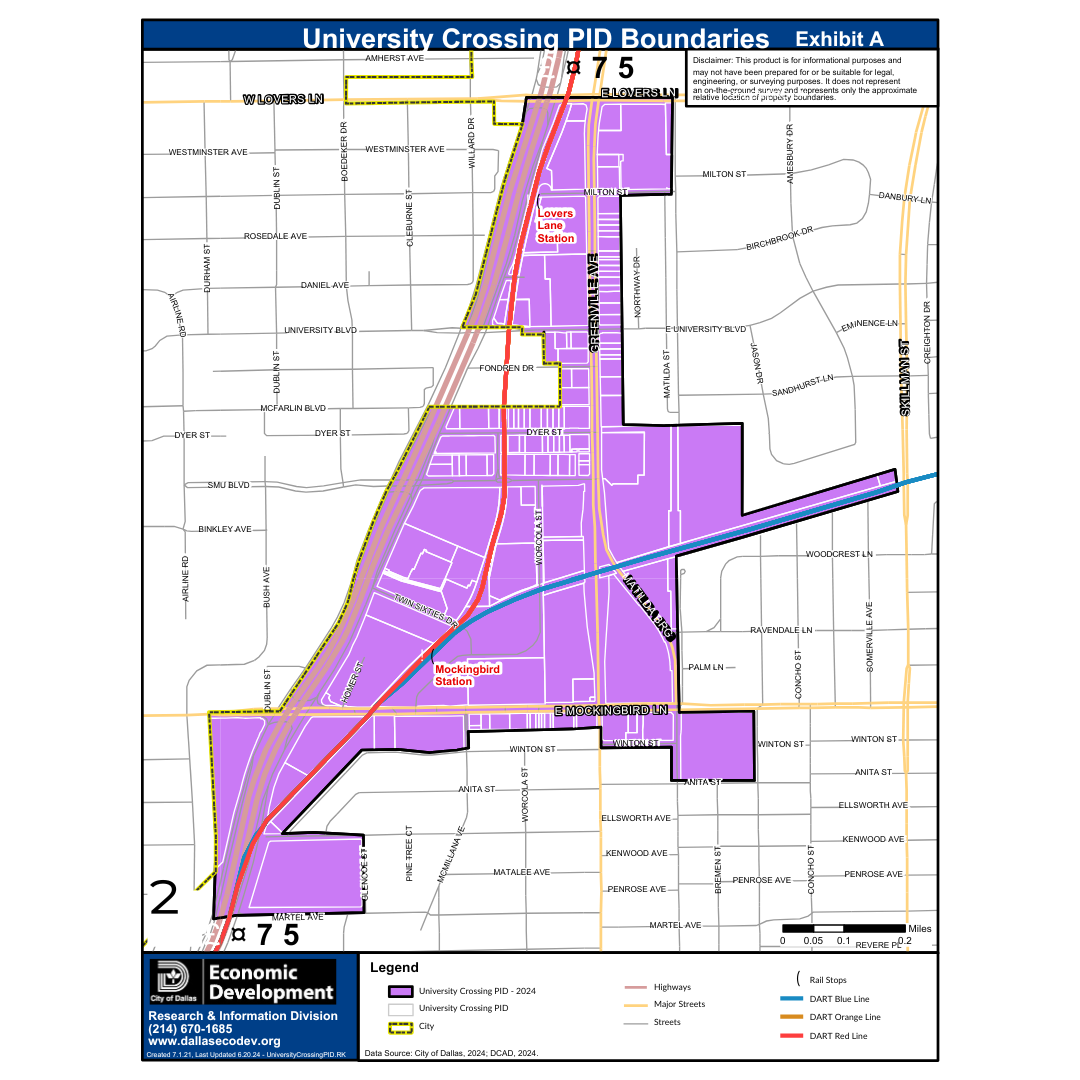

University Crossing PID Boundaries

The costs of the services and improvements by the University Crossing Public Improvement District (District) will be paid primarily by special assessment against properties in the District. Annual assessments are based on the total value of real property and real property improvements as determined by the Dallas Central Appraisal District.

The District’s proposed assessment rate for 2024 is $0.10 per $100 of appraised value. Once levied, this assessment rate shall not increase during the 2025 Service Plan year.

The City of Dallas is not responsible for payment of assessments against exempt City property in the District because City rights-of-way, railroad rights-of-way, City parks and cemeteries are not specially benefitted. Southern Methodist University (SMU) has agreed to participate in the University Crossing PID by contract with the University Crossing Improvement District Corporation through special assessment based on all taxable and tax exempt real property owned by SMU or SMU affiliates within the University Crossing PID. With the exception of SMU, payment of assessments by other tax-exempt jurisdictions and entities must be established by contract.